Schalk Louw is a portfolio manager at PSG Wealth.

There has been a big change in how much SA funds can invest pension money overseas – and they have already shifted a lot of money offshore, writes Schalk Louw.

For South African investors, the decision of when to increase offshore holdings and when to stay put has been a topic of significant debate over the past decade. This question becomes even more critical in a constantly changing economic landscape and evolving regulations.

Investors often find themselves in a position where they may not have a direct say in this matter, as fund and portfolio managers take the reins. However, this may not necessarily be a disadvantage, as these professionals are responsible for not only selecting the right stocks but also making sound multi-asset decisions.

Regulation 28 amendment

A significant turning point in the offshore holdings debate occurred during the February 2022 Budget Speech when the Minister of Finance announced an amendment to Regulation 28 of the Pension Fund Act.

This change increased the allowable offshore holdings from 30% to the current 45%.

The impact of this announcement reverberated not only through the retirement industry but also significantly affected the unit trust industry. This is because most of the largest funds in South Africa are categorised within the SA Multi-Asset High Equity sector, and these funds must comply with Regulation 28 of the Pension Fund Act.

Gradual adjustments

Ernest Hemingway’s phrase “gradually, then suddenly” perfectly describes how managers of these funds adjusted their portfolios after the announcement.

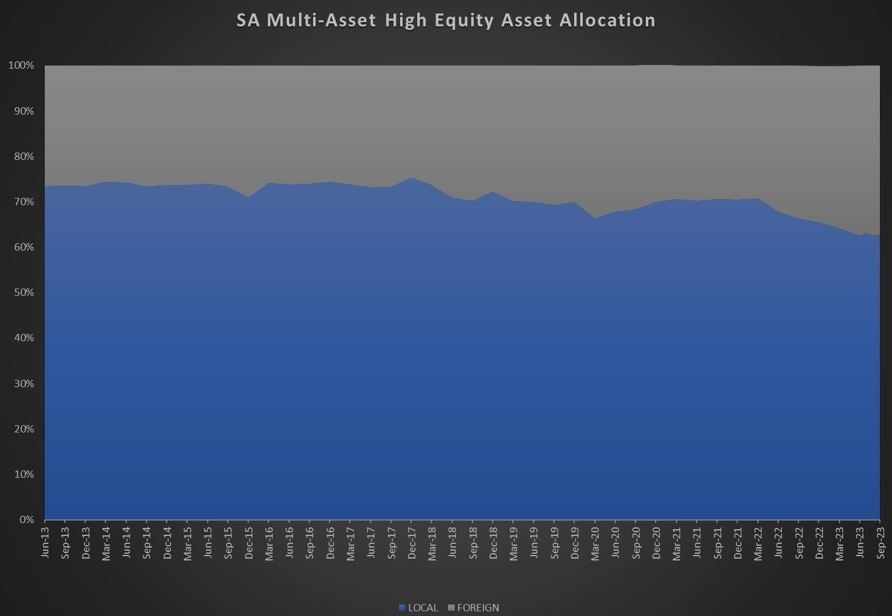

An examination of the top 10 largest SA Multi-Asset High Equity Funds (large managers) reveals that managers were initially cautious, maintaining their offshore holdings at around 30%.

It was only around the middle of last year that there was a noticeable uptick in offshore investments. As of the latest available data (30 September 2023), the average offshore weight for these large managers now exceeds 37%.

Shifting strategies

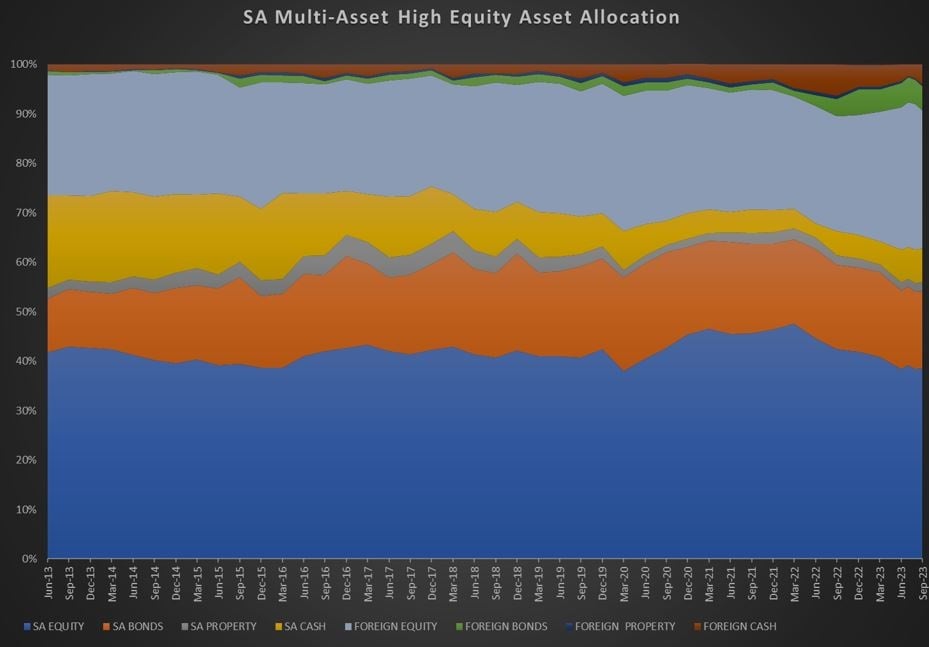

The increase in offshore holdings came primarily from the sale of local equities, resulting in not only foreign investors but also local investors becoming net sellers of South African equities.

Interestingly, while these funds initially favoured offshore equities, we observed a shift towards offshore bonds.

This change in asset allocation reflects the evolving investment strategies of fund managers in response to changing market conditions.

Crucial considerations

Before you decide to increase your offshore exposure, it’s vital to understand how your fund managers have adjusted their strategies in recent months.

South Africa remains in a value investing territory, and opportunities may still arise in local markets. While international diversification is essential for risk management and returns, don’t overlook the potential for growth right here at home. Most importantly, it is advisable to entrust the task to professionals.

Stay vigilant

The decision of when to increase your offshore holdings in South Africa has become increasingly important, especially with the recent regulatory changes.

While it’s crucial to take advantage of global opportunities and diversify your investments, it’s equally important to stay informed about your fund manager’s strategies and the ongoing developments in both local and international markets.

South Africa may still hold promise, and it’s wise to remain vigilant for opportunities that may arise “suddenly” when the country regains favour in the investment landscape.

Schalk Louw is a portfolio manager and strategist at PSG Wealth Old Oak.

News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.

Disclaimer: News24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, News24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Recent Comments