South African equity markets closed in the red yesterday, as a stronger US jobs report weighed the likelihood of early rate cuts.

Platinum miners Impala Platinum, Northam Platinum, and Anglo American Platinum dropped 3.9%, 3.0%, and 1.4%, respectively.

Diversified miners Kumba Iron Ore, Anglo American, African Rainbow Minerals and Exxaro Resources declined 2.4%, 1.5%, 1.1%, and 1.0%, respectively.

Gold miners, Harmony Gold Mining, Gold Fields, and AngloGold Ashanti shed 2.2%, 2.1%, and 1.7%, respectively.

On the flip side, telecommunications companies, Telkom SA SOC and Blue Label Telecoms advanced 2.5% and 2.0%, respectively.

Retailers Pick n Pay Stores and Clicks Group gained 2.0% and 1.8%, respectively.

The JSE All Share index declined 0.5% to close at 74,033.94.

Yesterday, the South African rand weakened against the US dollar. In the US, the ISM services PMI rose more than expected in January. Moreover, the S&P Global services PMI climbed in January. The yield on benchmark government bonds rose yesterday. The yield on the 2030 bond advanced to 9.87%, while that for the longer-dated 2040 issue rose to 12.32%.

Market update by Anchor Capital

US markets ended lower yesterday, following US Federal Reserve Chair Jerome Powell’s hawkish stance on rate cuts and mixed US earnings results.

Technology companies, Microsoft and Cisco Systems dropped 1.4% and 1.3%, respectively. Aircrafts company Boeing shed 1.3%, after the company said new quality glitch in some 737 MAX planes could delay some deliveries. Cosmetic company Estee Lauder climbed 12.1%, after the company announced plans to cut 3.0% to 5.0% of its global workforce. Construction company Caterpillar advanced 2.0%, after the company reported higher profits in FY23.

The S&P 500 index fell 0.3% to settle at 4 942.81, while the DJIA index declined 0.7% to close at 38,380.12. The NASDAQ index eased 0.2% to end the trading session at 15,597.68.At 05:30 SAST today, Brent prices rose 0.1% to trade at $78.08/bl.

Yesterday, Brent prices rose 0.9% to settle at $77.99/bl, amid supply concerns. At 05:30 SAST today, gold prices marginally declined to trade at $2 024.39/oz.

Yesterday, gold declined 0.7% to close at $2 024.67/oz, as a stronger dollar and a rise in the US Treasury yields dented demand for the safehaven yellow metal.

Yesterday, copper marginally declined to close at $8 374.19/mt. Aluminium closed 1.2% lower at $2 212.65/mt.

Lyft makes a mistake with a number – shares jump almost 70%

It was, without a doubt, a strong earnings report.

Lyft projected adjusted earnings as much as 11% higher than analysts’ estimates, and reported bookings ahead of expectations. And then there was the outlook for profitability: Margins, the ride-hailing provider said in an initial press release Tuesday, were set to expand this year by an eye-watering 500 basis points. Shares surged, jumping 67% in after-hours trading.

But the projection was off. Way off. Less than an hour after issuing the statement, Lyft Chief Financial Officer Erin Brewer joined a call with analysts and said the company is actually expecting margins to expand by 50 basis points — not 500 — acknowledging, when asked by an analyst, that the press release was incorrect. A company spokesperson later attributed the mistake to a “clerical error”, and the company eventually corrected its statement and regulatory filings. Shares almost immediately gave up gains. By the time premarket trading opened on Wednesday morning, its rally had pared to about 20%. It’s a “black-eye moment” for Lyft, said Dan Ives, an analyst at Wedbush Securities, “a debacle of epic proportions”.

He said by email that he’d “never seen an error like this in my almost 25 years on the Street”.

The mistake overshadowed what was otherwise a solid beat on profit and bookings projections that signalled a years-long effort to boost ridership and challenge Uber Technologies Inc. may be paying off. In fact, both Lyft and Uber delivered strong earnings reports this quarter, suggesting continued growth in overall rider demand since a nationwide plunge during the pandemic. The two have spent fiercely to recruit and retain enough drivers to meet the rise in orders. Lyft chief executive officer David Risher, who took the helm less than a year ago, has focused the operations on customer satisfaction and has emphasised a return to the basics in an effort to close the gap with Uber. Lyft has spent millions of dollars to lure drivers but has had a hard time boosting its rider base.

“Lyft clearly did one thing right – it corrected the error quickly and decisively,” said Brad Foster, a partner specialising in securities litigation at corporate law firm Haynes Boone. “The reality is that people make mistakes, and mistakes are not securities fraud.

“In the fourth quarter, Lyft said gross bookings jumped 17% from a year earlier to $3.72 billion, ahead of estimates for $3.67 billion. Revenue was $1.22 billion, up 4% from a year earlier and in line with projections. And it projected adjusted earnings of as much as $55 million in the first three months of the year, topping analysts’ estimates of $49.5 million. Lyft said the number of active riders on its platform increased 10% in the fourth quarter from a year earlier to 22.4 million. Last year, Lyft had more than 40 million riders, the highest annual ridership in its history.”We’ve entered 2024 with a lot of momentum and a clear focus on operational excellence,” CFO Brewer said, positioning the company to “drive meaningful margin expansion and our first full-year of positive free cash flow”.

But Lyft still lags behind Uber. According to market research firm YipitData, the company has held around 30% of the US rideshare market compared with 70% for Uber since the second quarter of 2022. Last week, Uber reported its full year of profit as a public company and said trips rose 24% in the quarter to 2.6 billion. Stabilising its market share is a critical first step for Lyft in building investors’ confidence “in the long-term story”, analysts at Jeffries Capital Management LLC wrote before the company’s results were released. Lyft said adjusted earnings before interest, tax, depreciation and amortisation were $66.6 million in the fourth quarter, beating the $56 million estimated by analysts. It reported a net loss of $26.3 million.

– Bloomberg

Adriaan Pask, chief investment officer, PSG Wealth

The rise in life expectancy poses a significant challenge for individuals planning for retirement, necessitating a shift in the approach to financial preparedness. As people live longer, the duration of retirement increases, and with it, the financial demands. Longer lifespans imply more years of healthcare expenses, potential long-term care needs, and sustained financial support during retirement. To ensure a comfortable and secure lifestyle during retirement, individuals must be diligent and strategic in how they save.

The goal of retirement savings is to generate long-term real returns

Saving for retirement is fundamentally a long-term financial strategy, and its success hinges on the ability to generate real returns over time. Generating real returns (or returns adjusted for inflation) ensures that the purchasing power of savings is preserved. In the context of retirement planning, the emphasis on real returns becomes crucial because it reflects the actual increase in wealth that outpaces the erosion caused by inflation. Unlike shorter-term financial goals, retirement planning therefore requires exposure to equities, as it is the asset class that delivers the best protection against inflation over longer periods.

The value in embracing equities

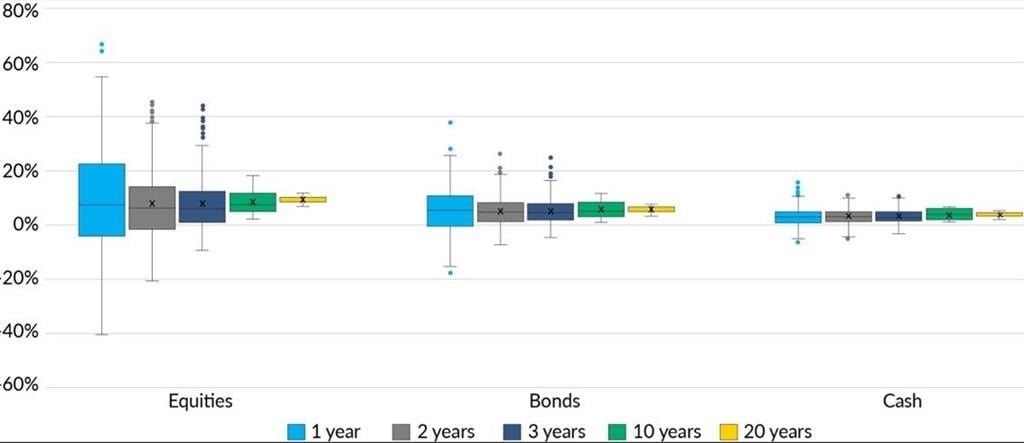

Embracing equities is a strategic approach that not only diversifies risk but also serves as a powerful tool for maximising wealth creation. This is especially true if investments are responsibly managed by a skilled and experienced manager as part of a diverse portfolio. While equities are often misunderstood and are notorious for displaying the most volatility over the short term, returns over the long term are not as unpredictable as commonly believed.

By allocating a portion of their investment portfolios to a diverse range of stocks, investors can spread risk across different industries, sectors, and geographic regions. This diversification helps mitigate the impact of deficient performance in any single investment, as gains in one area may offset losses in another. While equities inherently carry more volatility than other investment instruments, they also offer potential for long-term capital appreciation, and dividends can contribute significantly to overall wealth accumulation.

As seen in the graph below, the actual returns on cash have been in a very limited range since 1985, as one would expect. However, while equities have a wider range in the short term, real returns from equity exposure have a narrower range in the long term. The longer the investment period, the more certainty that the asset class will deliver superior returns.

Have a long-term mindset

To beat inflation over the long term, seasoned investors often turn to equities as an asset class, given their historical potential for higher returns. However, the stock market is inherently subject to fluctuations influenced by a range of factors, including economic indicators, market sentiment, and geopolitical events.

While short-term volatility may lead to fluctuations in the value of equity investments, the long-term trajectory has shown a capacity to outpace inflation. Thus, investors with an investment horizon that spans several decades can benefit from the compounding effect and the overall growth potential of equities, even as they navigate temporary difficulties in the market. A balanced and diversified portfolio that considers both risk and return can be a prudent strategy for investors aiming to beat inflation over the long term.

Did you know?

- Over a 40-year investment horizon, it is possible that the US economy could go through approximately eight recessions, although the timing and severity would be subject to various economic and geopolitical dynamics.

- Since the S&P 500’s inception in 1957, there have been twelve bear markets, one of which occurred in 1990 and saw a 19.90% decline in the benchmark index.

- Nevertheless, the index has returned more than 65 000% overall since 1957, despite these frequent losses. The latest cycle ended in 2022 and lasted eight months, and the index fell by 25%. Markets have recovered since then.

- Just like every season ends, and we welcome a new one, bull markets follow bear markets. Bull markets typically last three times longer than bear markets on average. The average bull market gain is about 111%.

- About 42% of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 36% of the market’s best days took place in the first two months of a bull market before it was clear that a bull market had begun.

Staying the course

Maintaining a disciplined approach and adhering to your established plan and asset allocation is a key principle in achieving long-term wealth-creation goals. Unfortunately, many investors tend to move away from equities into less risky, more conservative investments when market volatility increases, which comes with a long-term opportunity cost. It is important to understand that markets naturally experience difficulties, but attempting to time these movements can be challenging and often counterproductive.

Emotional reactions to market fluctuations or short-term uncertainties can lead to impulsive decision-making that may undermine the overall investment strategy and jeopardise the outcome of the long-term financial plan. Opting for a balanced mix of growth and conservative investments instead is often a more prudent approach for long-term investors. Regularly reviewing and rebalancing portfolios in consultation with a financial adviser ensures that investment strategies remain aligned with evolving financial objectives while minimising emotional responses to short-term market fluctuations. The best way to weather uncertainty is to stay invested. Accept the short-term volatility and be rewarded for your patience in the long term.

Tweet of the day

The probability of a March rate cut moved down to 9% after the hotter-than-expected inflation report. Only a month ago the probability was 77%. pic.twitter.com/TCiv7Y1Pts

— Charlie Bilello (@charliebilello) February 13, 2024

Disclaimer: News24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, News24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.

Recent Comments