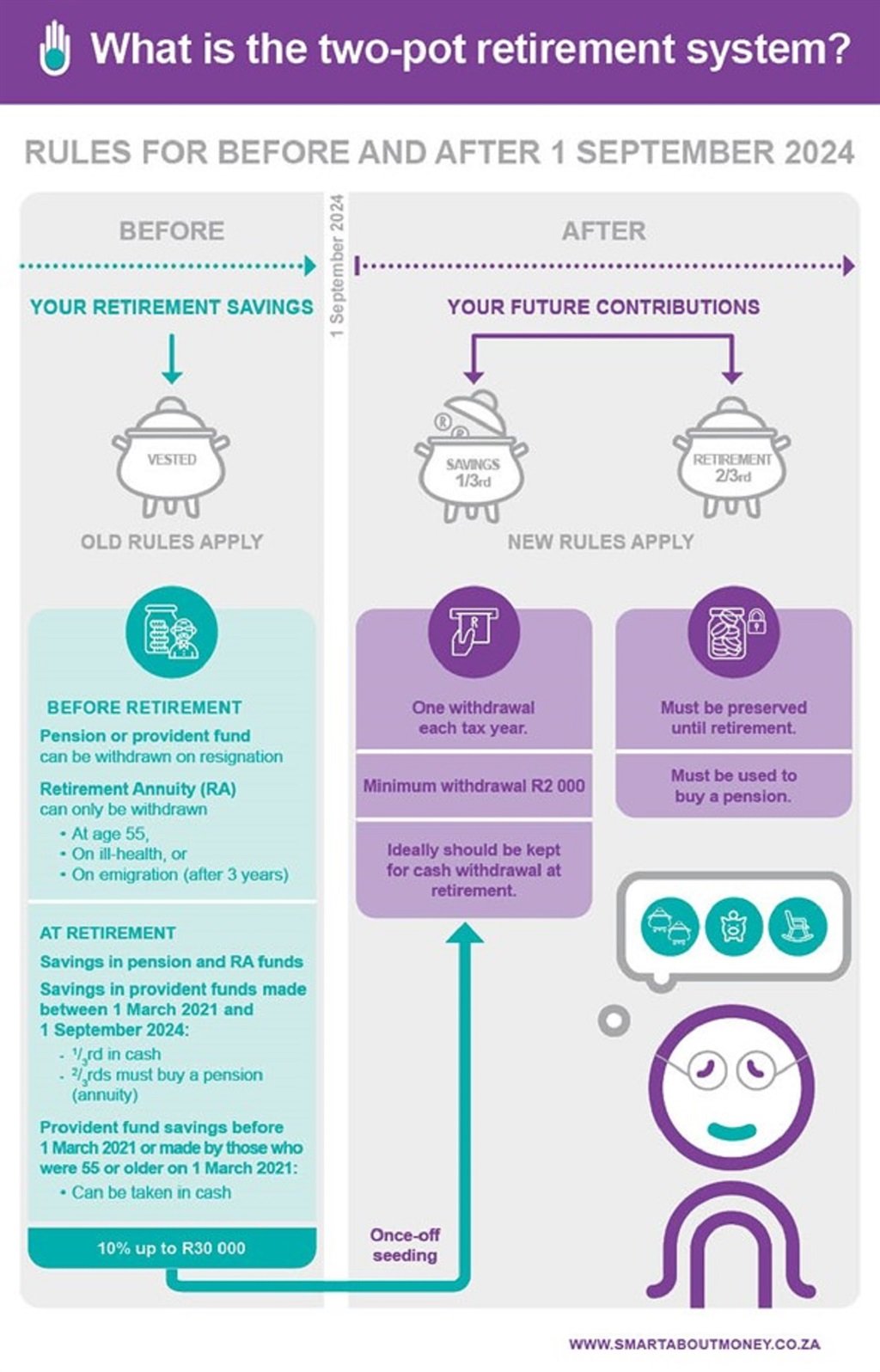

- While it is called the two-pot system, will split your future retirement savings into three “pots”.

- Your savings will be allocated to savings, retirement and vested pots.

- You can withdraw from your savings pot once every tax year as long as you have at least R2 000 to withdraw.

- For more financial stories, go to the News24 Business front page.

The two-pot retirement savings system will split all your retirement fund contributions (after expenses) from 1 September 2024 into two notional pots.

Savings pot:

One third of your contributions will be saved in a savings pot that you can access once in a tax year.

Retirement pot:

Two-thirds of your contributions will be saved in a retirement pot that you cannot access until retirement.

The two-pot system, in fact, introduces three pots, because what you have saved when the new system comes in will be held in a third pot:

Vested pot:

This pot will hold your savings in the fund made before 1 September 2024 plus fund return on this. You will generally be able to do with the retirement savings in this pot what you could do with your retirement savings before 1 September 2024. So, for example, you can still take it in cash if you resign, are retrenched or dismissed from an employer-sponsored fund, but your savings in this pot in a retirement annuity (RA) will generally not be available until age 55.

How does the two-pot system differ from the current system?

In addition to splitting your contributions, there are new rules about what you can withdraw and when.

In terms of the current system:

Generally, you cannot access or withdraw your retirement savings in a pension or provident fund before retirement unless your employment is terminated and you leave the fund or you retire.

If your employment is terminated because you resign, are dismissed or retrenched, you can withdraw your retirement savings in cash in full after tax.

You cannot access your savings in an RA fund before age 55. There are a few limited exceptions to this, such as on emigration and ill health.

Under the two-pot system:

You can withdraw what is in your savings pot in any fund once in every tax year as long as you have at least R2 000 in the pot.

When you withdraw from the savings pot you access savings for a cash lump sum at retirement early. The more you take early, the less you will have in cash at retirement.

You cannot withdraw what’s in the retirement pot until retirement.

The rules of the current system will apply to your vested pot, so you will be able to withdraw from this pot in cash in an employer-sponsored fund on resignation, retrenchment or dismissal.

When will the two-pot retirement system be implemented?

The implementation date is 1 September 2024. This date has been set legislation and is highly unlikely to change.

What laws introduce the two-pot system?

The Revenue Laws Amendment Act was the first law approved by Parliament in 2023 and signed into law, giving effect to the new system and setting the implementation date.

The Pension Funds Amendment Bill was approved by Parliament in May 2024 but still needs to be signed into law. It introduces changes to the Pension Funds Act and includes funds not regulated by the Pension Funds Act in the new system.

The Revenue Laws Second Amendment Bill 2024 will make changes to how the two-pot system works and this bill has yet to go through Parliament.

Which retirement funds will be included in the two-pot system?

The two-pot system applies to:

- Pension funds including both defined benefit and defined contribution pension funds;

- Pension preservation funds;

- Provident funds;

- Provident preservation funds;

- Retirement annuity (RA) funds; and

- The Government Employees Pension Fund, the Transnet and Telkom retirement funds that are governed by legislation other than the Pension Funds Act.

Which retirement funds will not be included in the two-pot system?

The only funds that will be excluded from the two-pot system are:

- Older “legacy” policies, held by an RA fund, entered into before 1 September 2024 with a pre-universal life or universal life (death benefit and savings) structure;

- Beneficiary funds that hold deceased members’ benefits to pay regular benefits typically to minor children; and

- Unclaimed benefit funds.

Certain members may be excluded from the two-pot system including:

- Members of a provident fund who were 55 years or older on 1 March 2021 and are still a member of the same provident fund. These members will, by default, continue saving for retirement under the old system, but they can choose to opt into the two-pot system before 1 September 2025; and

- Pensioner members of funds.

This article was first published on SmartAboutMoney.co.za, an initiative by the Association for Savings and Investment South Africa (ASISA).

News24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, News24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Recent Comments