Calib Cassim, acting group chief executive, announced Eskom’s results for the 2023 financial year.

Eskom has witnessed a year of despair.

The company unveiled its integrated results for the financial year 2023 on Tuesday afternoon, with a grim set of statistics that suggest Eskom has plenty more dark days ahead.

The numbers paint a dark picture

Eskom’s financial report is nothing short of a nightmare, with headline numbers reflecting the utility’s dire situation.

A staggering increase in the net loss after tax, which skyrocketed to R23.9 billion from R11.9 billion, demonstrates a precipitous financial decline.

The Energy Availability Factor (EAF), a critical indicator of efficiency, plunged from 62.02% to 56.03%.

Load shedding intensified with an astonishing 215 additional days of power cuts compared to the previous year. To make matters worse, consumers are now paying more for this inadequate service, as a tariff increase of 9.61% further burdens their pockets.

The municipality’s debt has swelled by R24.1 billion, reaching R58.5 billion, contributing to Eskom’s financial woes.

A new leader takes the helm

In March 2023, Kgosientsho Ramakgopa assumed the role of electricity minister with the arduous task of tackling load shedding and the broader electricity crisis.

However, the challenges he faces are monumental.

The report reveals that Eskom recorded a net loss after tax of R23.9 billion for the year and meagre earnings before interest, tax, depreciation, and amortisation of R38.0 billion.

The earnings margin has declined to 14.7%, primarily due to surging primary energy costs linked to costly open cycle gas turbine (OCGT) production.

A 5% drop in sales volume, attributed to load shedding and an overall economic decline, further compounds the company’s financial woes.

Revenue increase, yet troubling expenses

While revenue saw an increase of R11.9 billion, reaching R259.5 billion, the main contributor was the 9.61% tariff increase permitted by the National Energy Regulator of SA, which failed to compensate for the decline in sales volume.

Primary energy expenses surged to R154.9 billion despite a decrease in production. Eskom and independent power producers Open-cycle gas turbine costs, as well as rising gas and fuel oil expenses, are significant contributing factors.

READ: Eskom slammed for logo redesign tender amid ongoing load shedding crisis, rising power costs

Eskom’s generation costs rose to R106.7 billion, largely driven by the increased expenditure on Eskom-owned open-cyle gas turbines, which reached R21.4 billion due to higher diesel prices and enhanced gas turbine production.

The independent power producer’s expenditure also escalated to R41.8 billion, attributed to the more extensive use of IPP OCGTs and the persistent rise in diesel prices.

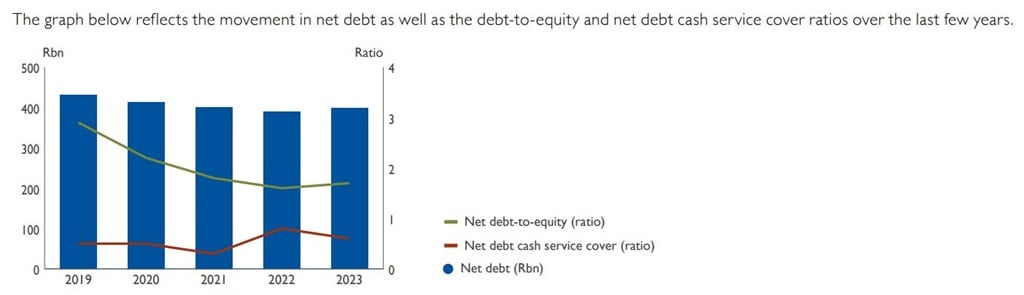

Liquidity crisis and debt relief

Eskom faces a severe liquidity challenge, leading the company to curtail organisational cash requirements by limiting capital expenditure and achieving operating expenditure savings of R27.8 billion against a target of R21.4 billion.

The Eskom Debt Relief Act, enacted in 2023, will provide debt relief of R254 billion over the next three years, with substantial liquidity support in 2024, 2025 and 2026.

A key condition for this relief is the sale of Eskom Finance Company, which, if not accomplished, could jeopardise the available funds in 2024 and 2025.

Operational woes persist

Eskom’s operational performance paints an equally dire picture.

Hindered by factors, such as an ageing coal fleet, prolonged outages and energy unavailability from renewable energy-independent power producers, the utility incurred additional costs from using alternate and more expensive energy sources.

READ: Ramokgopa praises experienced power station staff for lower stages of load shedding

Load shedding was required on a staggering 280 days during the year, resulting in a significant reduction in supply. Eskom’s OCGT load factor for the year exceeded the target at 14.3%, reflecting the poor performance of coal-fired generation and lower production from renewable energy-independent power producers.

Recovery plan falls short

Eskom’s recovery plan aims to enhance generation performance and plant reliability, targeting an EAF level of 65% by March 2024 and at least 70% by March 2025.

However, despite some progress, the actual EAF performance stands at a disappointing 55.3% during the first two quarters of 2024, remaining below the target.

Efforts to extend the operational life of the Koeberg Power Station beyond 2024 are under way, with a request to separate the long-term operations licence for the two units in a bid to mitigate potential regulatory delays.

Recent Comments