Finance Minister Enoch Godongwana, delivers his budget speech on Wednesday 21 February.

This year’s budget speech, considering the election proclamation date of 29 May, is decidedly underwhelming. For critics expecting dramatic spending increases or grand populist plans, there was little to whine about. In fact, the finance minister has declared that, for the first time since 2008/9, the country will declare a primary budget surplus (if you strip out debt repayments).

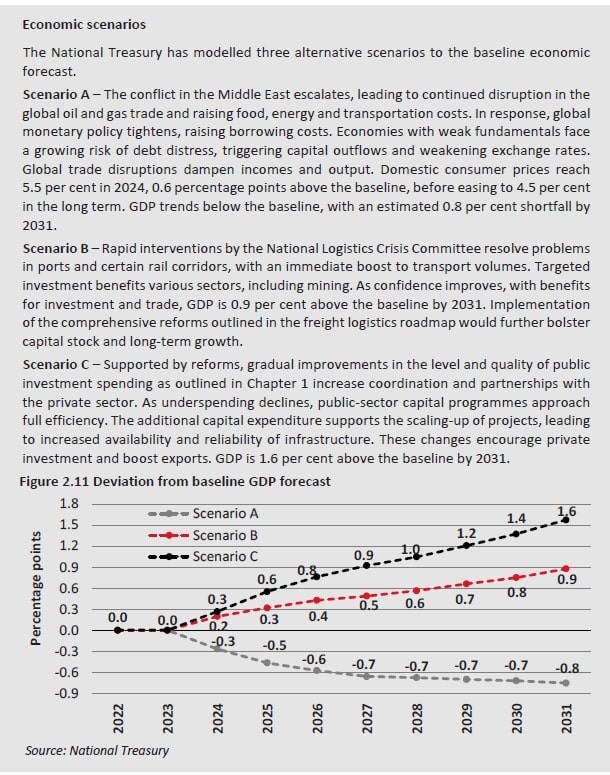

For anyone in South Africa who has been living under a rock, the country is on a poor growth trajectory. GDP growth last year was a paltry 0.6%, dragged down by the perpetual power crisis, rolling blackouts, operational and maintenance failures in freight rail and at ports, and high living costs – all squeezing the consumer.

READ: SA’s economy slips in the third quarter after two quarters of growth

With some optimism, the medium-term outlook has improved marginally, with average growth of 1.6% forecast, compared with 1.4% at the time of the 2023 medium-term budget policy statement (MTBPS).

Over the long term, GDP growth for the country has averaged only 0.8% since 2012, a rate of economic growth that is insufficient to address high levels of unemployment and poverty. A growth rate of 5% or better is critical to tackle the deepening unemployment crisis in the country.

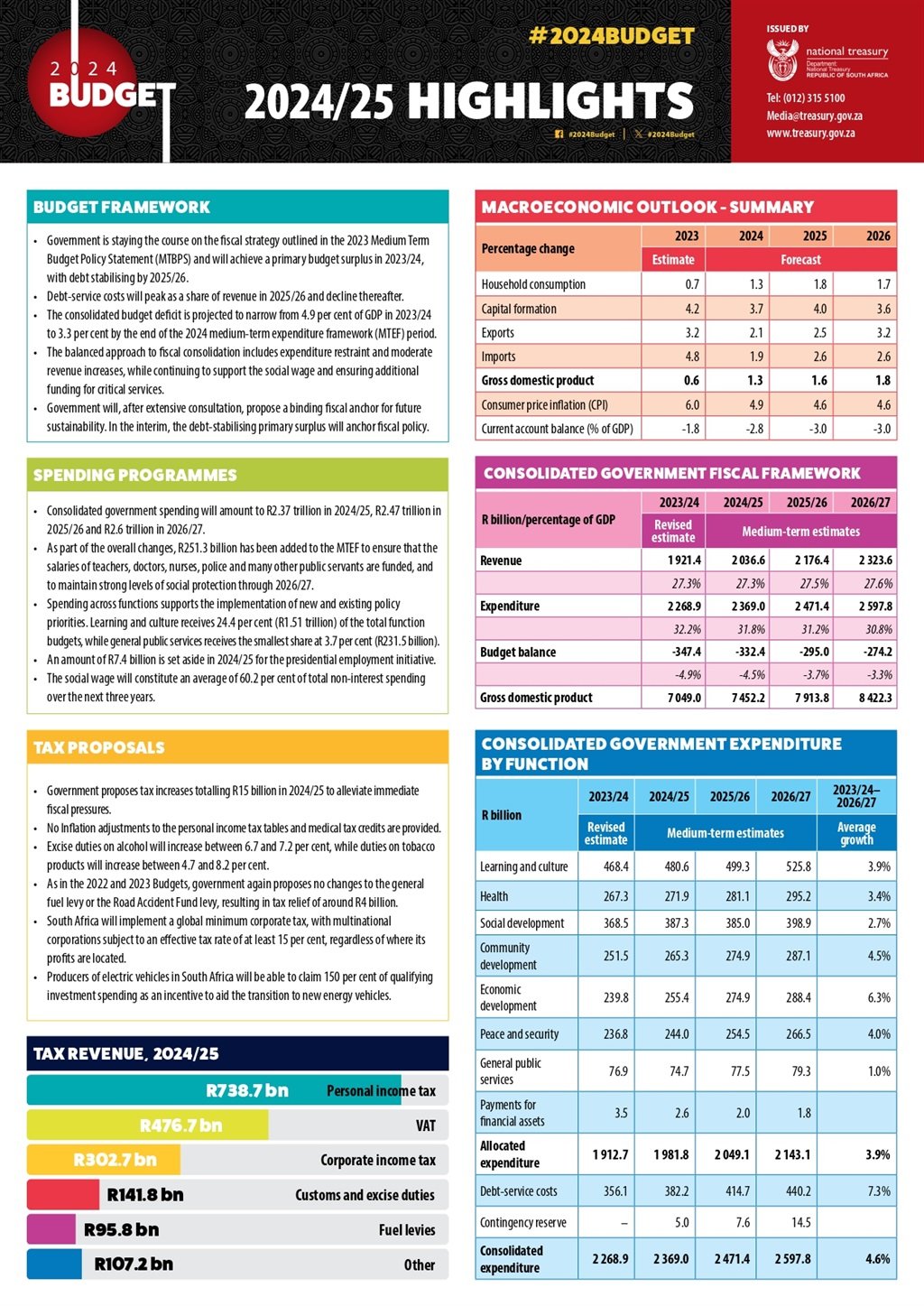

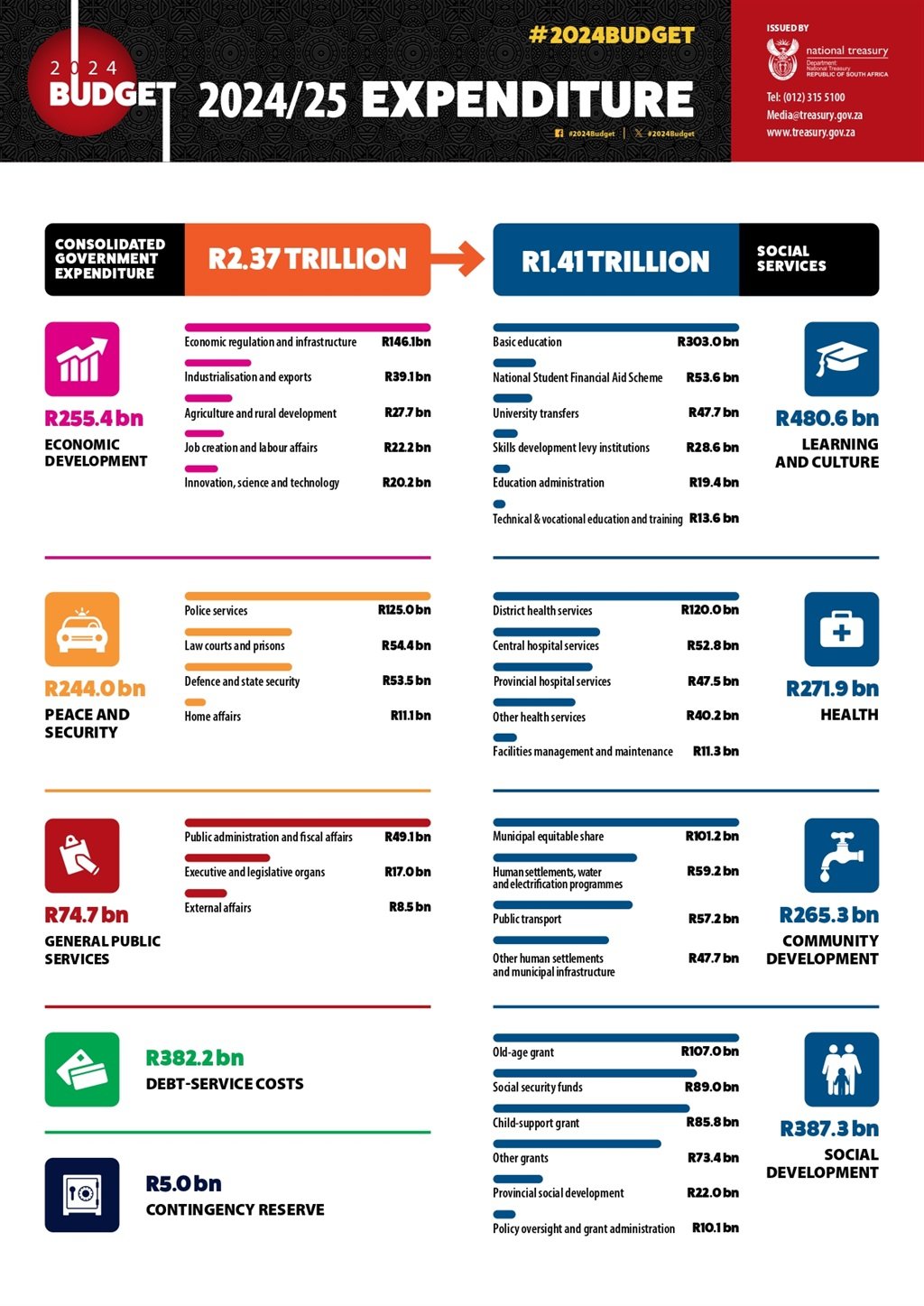

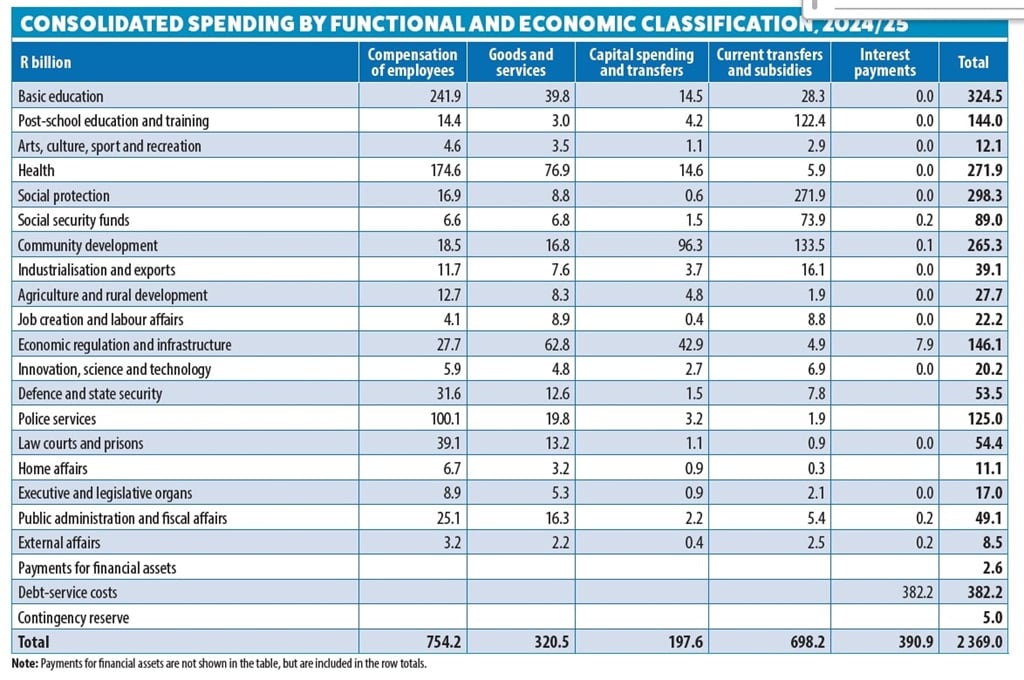

The minister will spend R2.37 trillion in 2024/25, R2.47 trillion in 2025/26 and R2.6 trillion in 2026/27. This, of course, is not what gets allocated to ensuring the country’s infrastructure, health, education, social services, policing and security.

The government’s wage bill now comes in at a staggering R754 billion. The public sector wage agreement reached last year will see an additional R147 billion allocated to compensate for the higher load.

READ: Goeffrey Nolting | The return on investment of the public sector wage bill

Debt repayments continue to weigh heavily on the fiscus, taking up 20 cents of every rand of spending – totalling R382.2 billion. The minister is optimistic about stabilising the debt level at 75.3% of GDP by 2025/26.

READ: So much debt and so little to show for it

These measures, says Finance Minister Enoch Godongwana:

Put us in a position to protect core services. It allows 60% of non-interest spending to be directed to the social wage. It also allows us to preserve capital spending.

The fiscus will also draw down R250 billion from the Reserve Bank’s contingency fund. It will use R100 billion this year and R25 billion a year for the following two financial years.

Without selling the assets, this cash will create a financial liability for which R100 billion has been allocated to mop up liquidity and essentially act as a sterilisation cost for the use of the funds. Any future gains on reserves will revert to the Reserve Bank.

Godongwana said:

This money will only be utilised once sufficient buffers are available to absorb exchange rate swings and the solvency of the Reserve Bank is not compromised.

The key message, says Godongwana, is that the economy needs massive investment to grow and create jobs.

Recent Comments