Africa is unlike any other continent when it comes to global net zero – and we need a blueprint for a common negotiating stance that reflects this,” says Samaila Zubairu, president and CEO of Africa Finance Corporation (AFC). The organisation is playing a leading role in building capacity and raising finance to drive the continent’s energy transition while maintaining a pragmatic view of how to leverage countries’ existing resources for economic growth. But it is also facing the challenge of dealing with priorities defined by some of the biggest global emitters located in other regions, which are setting the rules for targets and strategies.

Africa’s experience is unique, says AFC in its white paper released last year, Roadmap to Africa’s COP: A Pragmatic Path to Net Zero. “It has borne the brunt of the most devastating impacts of climate change – from frequent floods to droughts and severe heatwaves, costing lives and livelihoods. By contrast, the continent contributes less than 4% of greenhouse gas emissions, reflecting Africa’s crippling energy deficit.”

Zubaira argues that the continent needs to lead and chart a new development path. Africa needs to adopt new financing models, to “finnovate”, as it says in the white paper, so that it can unlock local capital from sources such as its pension and insurance funds.

This can be done through innovative solutions such as de-risking mechanisms, first-loss guarantees and credit enhancement tools. AFC has used these tools to encourage local investments and make institutional investors comfortable enough to take calculated risks. AFC has done this to great effect, but it needs to be done at much greater scale across our continent.

Zubaira believes that to scale up impact, there need to be much stronger partnerships between public and private sector. Data is key. Better data helps de-risk projects and will encourage greater investments.

He says that we need to change our mindset in terms of how we approach value chains at a continental level. Batteries and electric vehicles provide a unique opportunity for the continent to think differently about value chains and creating and capturing enormous wealth in a sustainable manner on the African continent. But this can only happen through concerted efforts and deliberate policies. This is why AFC has financed feasibility studies in this space that have demonstrated a clear competitive advantage to its peers.

Defining a just transition

Zubairu argues that the continent needs to harness its resources to generate the energy for development. He maintains that Africa’s climate challenges put the continent’s GDP at risk by up to 35%, a number that will keep growing as long as the region lacks infrastructure that is resilient to the impact of climate change. But there is also an opportunity for the continent to seize the moment and build ecosystem of adaptation, he says.

“The just transition for us is access to energy that is affordable and does not compromise economic development, and energy access that allows for the key challenges around financing and adaptation to be resolved at the same time as economic development.

“When we look at projects and opportunities, we are trying to see how we can build an ecosystem along value chains that allow for carbon neutrality as we go along. But the focus is on economic development.”

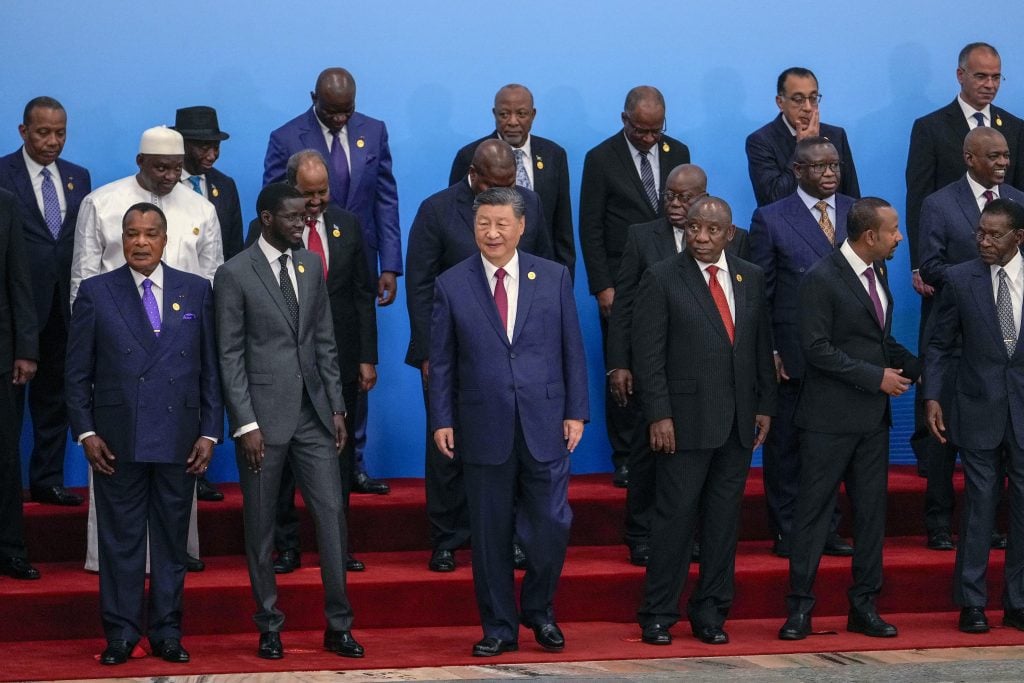

The pan-African organisation, headquartered in Lagos, has called on African leaders to engage in a unified narrative with the rest of the world to define the continent’s role in combating global warming. This engagement has moved centre stage as the world moves towards the COP28 meeting to be held in Dubai before the end of 2023.

A three-pronged approach

AFC, through its investments and project advisory function, has a three-pronged approach to climate change support for Africa.

It is localising production to minimise emissions from shipping and other forms of transport; rebuilding infrastructure in a way that will be resilient to changing climate conditions and that anticipates, prepares for, and adapts to climate risk; and using financial innovation to crowd-in investment to support everything from reforestation to renewable power plants.

AFC is moving quickly to develop renewable resources, boosting its footprint with the acquisition, with its partners, of Africa’s biggest renewable company, Lekela, and it has a pipeline of 10 GW of new projects. While renewable sources are the ultimate goal, Africa needs to move forward with the resources it has, says Sanjeev Gupta, AFC’s Executive Director for Financial Services.

The continent’s ambition to use its vast gas reserves as a transitional source of energy to support industrialisation has been given impetus by the European Commission’s decision to classify natural gas as a form of green energy and as a vital transition fuel in the path towards decarbonisation.

Given that significant swathes of Africa are already at net zero, industrial development using natural gas can be accomplished without substantial contributions to global carbon emissions, the AFC white paper states.

However, says Sanjeev Gupta, the acceptance of gas as a transitional fuel is not universally accepted and this can affect funding for projects involving this resource.

“We are doing what we can to develop renewable energy in countries that don’t have oil and gas, thereby helping to reduce their import bills. With oil and gas, the debate is more complicated,” he said.

The green strategy

Sameh Shenouda, Executive Director and Chief Investment Officer of AFC, says that while the Corporation has funded energy projects that pundits may not see as green projects at face value, it works to a broader strategy in this regard. One example is the deployment of $300m of senior debt to Dangote Industries Limited to part-finance the construction of its 650,000 barrel per day crude oil refinery. “African countries have different resources, and we look at what is on the ground and what it makes sense for the country to invest in. Where there is ample sun and wind, renewable energy makes sense.” But, he says, there are different ways of looking at this issue. “The west coast of Africa is gas rich so there is no good reason not to invest in gas. Nigeria is rich in oil and gas, so it makes sense to invest in these resources and we have invested in building refining capacity.”

For Nigeria to refine its own fuel rather than exporting the crude oil and importing fuel saves significant emissions from shipping,

Similarly, AFC backed the $335m Cabinda oil refinery in Angola, partnering with Gemcorp and Afreximbank. Angola also exports crude oil and imports fuel. Backing the refinery will significantly reduce these imports, saving both hard currency and shipping emissions.

Says Zubairu, “Import substitution is an effective way to reduce greenhouse emissions associated with shipping and it allows more jobs to be created in the local economy. It also creates an opportunity to scale up in order to meet not just local demand but that of its neighbours.”

The oil refinery deals are one aspect of this. Transport is another. The Lobito rail project, in which AFC is the lead developer, aims to provide a direct route from Zambia’s copper mining area to Lobito’s port in Angola. It will enable the movement of exports to the US directly west to the Atlantic Ocean rather than east to the Indian Ocean before being routed around Southern Africa.

Disrupting Africa’s typical trade patterns – raw materials out and manufactured products in – is also on AFC’s radar. Changing this will require developing local industries by putting processing and manufacturing at the centre of sustainable circular economies.

Currently, not even 20% of Africa’s food production is processed before being exported. AFC is backing special economic zones in various African countries to boost value addition to African commodities before export.

Says Shenouda, “In short, we are finding the most appropriate resource of each country and looking for non-traditional, adaptive and creative ways to address carbon emissions.

“We are able to do this as we know the terrain, what is required, and the potential as well as the limitations of each country. We are on the ground and understand Africa.

Derisking projects

AFC is able to derisk its projects by using its own equity capital upfront for projects, seeking debt funding once the project is commercially viable.

Says Shenouda, “It takes a long time to go through the project finance process, and it can take more than a year to raise debt. It is hard just to bring three or four banks into a room for a meeting. So it is quicker to bring our equity upfront in the beginning to get projects moving.” He uses the example of AFC’s 60 MW Djibouti wind project, inaugurated in October 2023, where AFC did an all-equity deal.

Once the project had reached commercial operations, it went to the market to raise debt finance. Now lenders are queuing up to bring capital into this de-risked operational asset.

Gupta says, however, that borrowing from the market puts the institution under pressure to meet the expectations of commercial lenders. This requires adhering to accepted policy direction and regulatory compliance and living up to environmental, social, and corporate governance (ESG) standards.

He said the fact that AFC has 42 member states under its umbrella gives it preferential access to those markets but it still has to ensure that projects are structured in ways that are politically untouchable and where policy is consistent. “Otherwise we would not be able to operate.”

AFC’s balance as a public private partnership is an important construct. While any development finance institution needs public sector support, it also depends on private sector rigour, he maintains.

However, raising capital remains challenging because of perceptions of high risk in Africa. Says Shenouda, “It would be really helpful if international sovereign funds and pension and insurance funds would put forward even 1% of their resources into Africa. That is not happening. Even African funds are not doing so.

One reason is a lack of knowledge about the continent, and undue perceptions of risk, which reduces the appetite for funding for Africa’s development, he maintains. AFC, on the other hand, understands where there is risk in Africa and is able to avoid or mitigate it. “From the outside, it is easy to say something is too risky. And we are cautious about which sectors we invest in.”

Recent Comments